Yields on gov’t debt drop on Fed bets

YIELDS on government securities (GS) went down last week as the market expects slower interest rate increases from the US Federal Reserve.

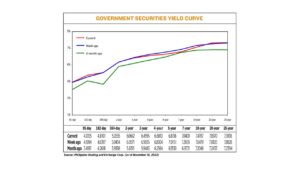

GS yields, which move opposite to prices, dropped by an average of 4.05 basis points (bps) at the secondary market week on week, according to the PHP Bloomberg Valuation Service Reference Rates as of Nov. 18 published on the Philippine Dealing System’s website.

Yields at the short end of the curve climbed as the 91-, 182-, and 346-day Treasury bills (T-bills) saw their rates increase by 1.11 bps, 17.04 bps, and 0.81 bp to 4.1205%, 4.8101%, and 5.0535%, respectively.

Yields at the belly declined, except for that on the two-year Treasury bond (T-bond), which inched by 0.81 bp to 6.0652%. The three-, four-, five-, and seven-year T-bonds fell by 4.40 bps (to 6.4595%), 11.94 bps (6.681%), 20.15 bps (6.8136%), and 22.50 bps (7.0409%), respectively.

Meanwhile, rates at the long end of the curve ended mixed. The rates of the 20- and 25-year debt papers rose by 8.50 bps (7.897%) and 3.10 bps (7.9138%), respectively, while that of the 10-year bond declined by 16.92 bps to 7.4787%.

Total GS volume reached P10.714 billion on Friday, lower than the P12.579 billion recorded on Nov. 11.

“Bond yields were mostly lower week on week, tracking lower US Treasury yields, due to the slower-than-expected inflation data from the US that bolstered bets that the Fed would moderate its aggressive rate hike path,” a bond trader said in a Viber message.

“The factors affecting this week’s movement were the 12-year auction, US Treasury trend, and the anticipation of the BSP (Bangko Sentral ng Pilipinas) hike,” Security Bank Corp. Chief Investment Officer for Trust and Asset Management Group Noel S. Reyes said in a Viber message.

“BSP policy rate is now at 5% and communication by them is that they need to maintain a point-for-point move to ensure inflation is contained and for the peso-dollar rate to not depreciate further. Inflation could be near its peak as what was suggested by the US Treasury yield movement. Hence, the market rallied, and yields came off for most of the week.”

The US consumer price index rose to 7.7% year on year in October, easing from the 8.2% print in September.

The slower-than-expected inflation print may mean the Fed can begin to consider smaller rate hikes as early as its Dec. 13-14 meeting. The Fed has already increased rates by 375 bps since March.

Meanwhile, the BSP on Thursday raised benchmark interest rates on Thursday for a sixth time this year, delivering a jumbo increase to rein in rising inflation and support the peso.

The central bank hiked borrowing costs by 75 bps last week, bringing total increases since May to 300 bps.

Philippine headline inflation surged to a near 14-year high of 7.7% in October. For the first 10 months, inflation averaged 5.4%, still lower than the BSP’s revised 5.8% full-year forecast but higher than its 2-4% target.

On the other hand, the Bureau of the Treasury (BTr) raised P35 billion as planned from its offer of reissued 25-year papers with a remaining life of 11 years and 11 months on Tuesday as total bids reached P80.953 billion.

The bonds were awarded at an average rate of 8.168%, 91.2 bps lower than the 9.08% average quoted for the bond when it was first offered on Nov. 3, 2009 and 108.2 bps below the 9.25% coupon for the issue.

For this week, the bond trader said local rates will continue to track movements of global yields for direction amid a lack of catalysts at home.

Meanwhile, Mr. Reyes expects the 20-year auction this week to affect yields. The BTr will offer P35 billion in fresh 20-year Treasury bonds on Tuesday. — M.I.U. Catilogo