Yields on gov’t debt rise as US CPI stays elevated

YIELDS on government securities (GS) rose last week as August US consumer inflation exceeded market expectations, strengthening the possibility of another aggressive rate hike from the US Federal Reserve this week.

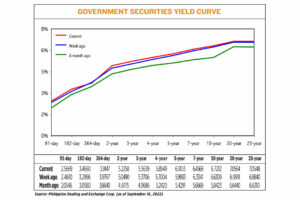

GS yields at the secondary market rose by an average of 10.98 basis points (bps) week on week, based on the PHP Bloomberg Valuation Service Reference Rates as of Sept. 16, published on the Philippine Dealing System’s website.

Rates at the short end of the curve were mixed, with the 91-, and 182- Treasury bills (T-bill) rising by 10.59 bps, and 16.94 bps to fetch 2.5669% and 3.469%, respectively, while the yield on the 364-day T-bill fell by 6.2 bps to 3.9147%.

Meanwhile, the belly of the curve climbed. Yields on the two-, three- four-, five-, and seven-year Treasury bonds (T-bond) went up by 17.68 bps (to 5.2258%), 19.33 bps (5.5639%), 15.45 bps (5.8549%), 12.10 bps (6.1103%) and 12.28 bps (6.4569%).

On the other hand, the long end of the curve moved upwards as yields on the 10-, 20-, and 25-year debt papers rose by 9.03 bps (6.7212%), 6.53 bps (7.0564%) and 7.08 bps (7.0548%).

Total GS volume traded reached P6.563 billion on Friday, lower than the P12.402 billion recorded on Sept. 9.

The first bond trader attributed the lower trading volume seen last week to cautiousness ahead of central bank meetings this week.

“GS yields increased during the week after US consumer inflation reports came out stronger than market expectations, bolstering views of potentially stronger Fed rate hike next week. Yields likewise rose from hawkish remarks by Fed officials Waller and George,” the first trader said in an e-mail.

“Local participants remained cautious ahead of the US consumer inflation report last week. As soon as the report indicated that the US central bank might consider a stronger 100-bp rate hike, participants dismissed any possibility for dovish policy hints from the Fed,” the trader added.

The second bond trader likewise said in a Viber message that the US consumer price index (CPI) was the catalyst for last week’s trading as it could prompt another aggressive rate hike from the Fed.

“That means there will also be pressure on other central banks, including BSP (Bangko Sentral ng Pilipinas), to raise rates as well due to the narrowing interest rate gap,” the second trader added.

The trader said players were defensive, pushing yields up.

US consumer prices rose in August amid rising rent and healthcare costs, strengthening the case for another jumbo-sized Fed hike this week.

Consumer inflation edged up by 0.1% to 8.3% last month after being unchanged in July. In the 12 months through August, the CPI increased to 8.3%.

The Fed is meeting to review policy on Sept. 20-21 and has raised rates by 225 bps since March, including two 75-bp hikes in June and July.

Meanwhile, the BSP will hold its own policy meeting on Sept. 22. The Monetary Board (MB) has hiked borrowing costs by 175 bps since May to rein in rising prices.

The first trader sees domestic yields moving with an upward bias this week on hawkish Fed bets.

“Bond yields might also increase as the BSP is likewise expected to respond with a substantial local policy rate hike in order to arrest any further weakening of the peso. However, the magnitude of increases might remain contingent on whether the policy rate hikes will be within or beyond market expectations,” the first bond trader added.

“The market will test BTr’s (Bureau of the Treasury) aggressiveness during Tuesday’s auction and wait for any clues ahead of MB meeting,” the second bond trader said.

On Tuesday, the BTr will auction off P35 billion in reissued seven-year bonds with a remaining life of six years and eight months. — A.M.P. Yraola