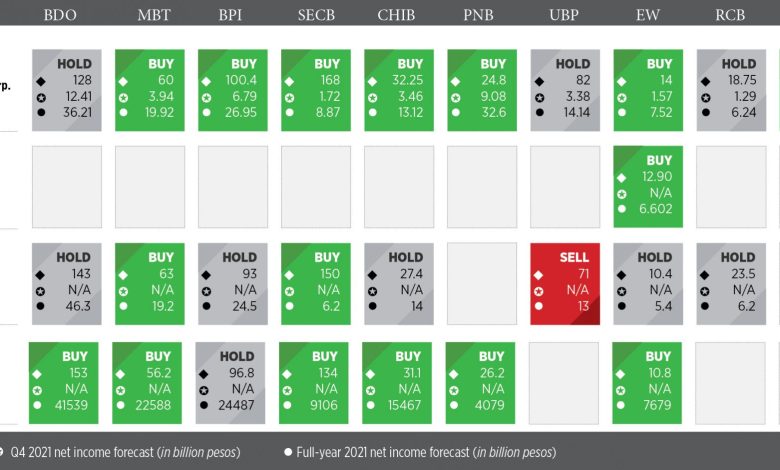

Analysts give rosy outlook on stocks

WITH THE ECONOMY showing signs of recovery, investors may consider bank stocks for next year as lenders are seen to be in a better position to bounce back compared with the previous quarters.

The Philippine Stock Exchange index (PSEi) averaged 6,751.98 in the third quarter, up 2.76% from 6,570.78 in the preceding quarter.

In comparison, the financials sub-index, which included the banks, grew at a slower pace with 1.1% to average 1,438.17 in the three months to September from 1,423.19 in the three months to June.

The third quarter saw 11 of the 14 listed banks whose share prices have fallen on a quarter-on-quarter basis. These were Rizal Commercial Banking Corp. (RCB, -18.1%), Philippine Business Bank (PBB, -15.1%), East West Banking Corp. (EW, -14.2%), Philippine National Bank (PNB, -10.6%), Metropolitan Bank & Trust Co. (MBT, -10.3%), Security Bank Corp. (SECB, -10.2%), Philippine Bank of Communications (PBCOM, -8.4%), Bank of the Philippine Islands (BPI, -8.2%), China Banking Corp. (CHIB, -5.3%), Asia United Bank (AUB, -2.4%), BDO Unibank, Inc. (BDO, -2.3%),

On the other hand, UnionBank of the Philippines (UBP) led gainers with 10.6%, followed by Philippine Trust Co. (PTC, 8%) and Philippine Savings Bank (PSB, 0.8%).

“What mainly affected bank stock performance in [the third quarter and early fourth quarter] were pandemic-related developments, particularly the rise in COVID-19 (coronavirus disease 2019) cases due to the Delta variant, subsequent tightening of restrictions, and eventual easing of quarantine classifications as daily virus case counts retreated,” said China Bank Securities Corp. Research Associate, Zoren Philip A. Musngi.

Mr. Musngi, however, noted a recovery in loan growth in August and September due to better lending activity “all of which are encouraging indicators that point to sustained economic recovery.”

Latest data by the Bangko Sentral ng Pilipinas (BSP) showed outstanding loans by universal and commercial banks (U/KBs) increased 2.7% in September, following an annual 1.3% growth in August. Prior to that, it had declined for eight straight months.

In a separate BSP release, U/KBs showed net interest margin — or the ratio that measure banks’ efficiency in investing their funds by dividing annualized net interest income to average earning assets — slightly declined to 3.33% as of September from 3.39% in end-June and 3.49% in end-March.

RCBC Securities, Inc. Equity Analyst King Patrick A. de Mesa noted most banks were able to substantially lower loan loss provisions, as well as see a recovery in fee-based income following the increase in transaction volumes due to the relaxation of quarantine restrictions.

“Aside from the respective banks’ earnings results, I think the recent economic reopening as well as the good GDP (gross domestic product) growth in [the third quarter] influenced bank stocks for the period,” Mr. De Mesa said.

PNB Senior Equity Research Analyst Wendy B. Estacio attributed the third-quarter result to the market’s anticipation in a decline in banks’ net interest income “as earning asset yield were repriced lower.”

“In addition, limited trading income was also priced in by the market as interest rates started to go up. As a reference, the 10-year BVAL (Bloomberg Valuation) rate increased by 58 basis points during the same period,” Ms. Estacio said, referring to the 10-year government bonds.

OUTLOOK

Analysts pinned their hopes on the economic recovery to be sustained into next year.

The second and third quarter saw GDP growing by 12% and 7.1%, respectively, following the economic recession that started in the first quarter of 2020 up until the same quarter of this year. Year to date, GDP expanded by 4.9%.

The country’s economic managers expect the economy to recover by 4%-5% for the entire 2021 following the record 9.5% plunge in 2020.

Metro Manila is currently under a more relaxed Alert Level 2, with businesses allowed operate at higher capacity. Economic managers expect the Alert Level to be further lowered to 1 by January 2022 as COVID-19 cases drop and the vaccination rate improves.

The government also expects nominal GDP to recover to pre-pandemic levels by early 2022.

“I expect listed banks to perform on a positive note for the rest of 2021 and for next year given attractive valuations and favorable economic outlook on the back of continuously improving virus situation in the country,” RCBC Securities’ Mr. De Mesa said.

“More mobility would mean more business activity, which could translate to higher loans, and subsequently, higher income for banks,” Mr. De Mesa added.

PNB’s Ms. Estacio noted that while the loan growth seen since August is still below its peak, investors should factor in a recovery in banks’ loan portfolios due to a rebound in household spending.

“Along with this, investors should remain on guard of the possible rise in banks’ nonperforming loans (NPL),” Ms. Estacio said.

Regina Capital Development Corp. Head of Sales Luis A. Limlingan shared a similar assessment.

“Determining whether or not a bank’s NPL coverage ratio is sufficient and if they’re at least meeting the required BSP capital requirements are also going to help gauge the future prospect of the banks,” he said.

Mr. Limlingan also cited the normalized loan loss provisioning, but noted it is difficult to determine whether the improvement will be substantial given uncertainties posed by the pandemic.

“Nonetheless, the rebound would likely be carried over into next year, assuming more business activity will be generated by then, following the increased vaccinated population, which will lead to the further easing of quarantine restrictions,” he noted.

NPLs held by big banks went up to P400.65 billion as of end-September compared with the P397.18 billion in end-June.

Their NPL ratio dipped to 3.99% in September from 4.03% in June. However, this remained higher than the 2.95% in September last year.

Meanwhile, the U/KBs’ NPL coverage ratio — which shows the allowance for potential losses due to bad loans — improved to 89.44% in September from June’s 87.63%. Still, it was below last year’s 102.9%.

China Bank Securities’ Mr. Musngi was also upbeat, advising investors to mainly focus on macroeconomic events such as the pandemic situation, pace of vaccinations, and changes in quarantine restrictions, as well as the industry’s indicators such as NPL coverage, interest rate outlook, and loan growth “as these will likely be the drivers for performance going forward.”

“In particular, investors should focus on banks with strong NPL coverage (over 100%) and improving NPL ratios, as these institutions would be in a better position to navigate future adverse surprises such as the emergence of another virus variant or re-imposition of restrictions,” he said.

He noted investors are particularly bullish in the sector given the improving outlook for loan growth as economic activity continues to pick up.

“This optimism holds despite expectations of higher interest rates in the coming year, since banks have already positioned themselves to benefit from higher rates. In addition, banks have been investing in more technological solutions such as digital banking, e-commerce, e-payments, which are growth areas that investors are focusing on as future value drivers,” he explained further.

First Metro Investment Corp. Head of Research Cristina S. Ulang expects “good share price performance” next year “in light of credit cycle pickup in sync with economic reopening.”