Customer behavior data fuels innovation in lending — Home Credit

By Patricia B. Mirasol, Reporter

IN A strategic move to meet the evolving financial needs of their customers, lending companies are increasingly turning to customer behavior analysis for developing innovative loan products, according to an industry player.

This approach has proven to be a game-changer, enabling lending companies to create loan solutions that resonate with their target markets, Sheila A. Paul, chief marketing officer at Home Credit Philippines, said in an interview with BusinessWorld.

“We pride ourselves on developing products that are not just financial tools, but actual solutions that align with our customers’ preferences and habits,” she noted.

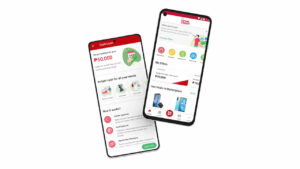

She said that Home Credit’s virtual credit line called Qwarta “didn’t exist pre-pandemic, but was developed because it caters to people who prefer making digital payments without the need to visit any physical outlets.”

Qwarta can be used for purchasing groceries, settling bills, and online shopping, including on the e-commerce platform Lazada.

“Let’s say you… bought something worth P2,000-3,000, you can use Home Credit to be able to pay for that 30 days later from when you purchased it,” Ms. Paul said.

Home Credit, which has been present in the country for a decade, has served 9.3 million Filipinos nationwide as of 2022. Nearly half (48%) of its customers earn less than P20,000 per month; three-tenths are under 30 years old, according to the company.

The country’s growing population, along with the millions of new graduates that enter the workforce annually and consequently require access to financial services, contributes to what Ms. Paul described as “a lot of uphill growth for us.”

According to the Bangko Sentral ng Pilipinas’ Financial Inclusion Report for 2021, ownership of a formal account in the Philippines increased to 56% in 2021 from 29% in 2019. Meanwhile, the adoption of formal credit increased to 25% from 19% within the same period.

The company uses big data collected from credit bureaus, telco usage, and other sources to assess an individual’s creditworthiness. An identification card and a mobile number are prerequisites for a loan application.

For those who prefer in-store shopping and have never engaged in installment or credit transactions, Home Credit’s sales force of 8,000 professionals across 15,000 stores throughout the country guides them through the process, Ms. Paul said.

The majority of Home Credit’s user base consists of government employees, those in the private sector, and individuals who receive remittances from overseas Filipino workers.

The gig economy, which includes freelancers, also presents opportunities for loan companies. According to Payoneer’s 2022 report on the Philippines’ freelance market, as many as 1.5 million Filipinos participate in freelancing platforms, undertaking tasks such as content creation and customer service for both local and foreign clients.

“Some of these people have buying power,” Ms. Paul said. “Since they don’t have tax returns and all that, they would not be accommodated by formal banks, but for sure we can give them a shot.”

BEHAVIORAL TRENDSAnother innovation of Home Credit is shoppingmall.ph, a website that consolidates product listings from 14,000 stores where it maintains a presence.

The idea for the site stemmed from the realization that people visit malls to window-shop for specific items — products that often have varying prices and discounts depending on the store, Ms. Paul said.

“What we try to do is aggregate these discounts and promos, present them to the public, and say ‘You don’t have to go and hop malls anymore.’ It’s hard to do it anyway these days,” she said.

“Depending on where we see the customer behavior going, that’s where we want to be able to innovate,” she added.

Home Credit, which used to mostly provide loans for electronics, now caters to loans that have also begun to resonate with its Filipino clients. These include installment plans for airplane tickets, optical products, wedding venues, and birthday parties.

“One thing that really took off for us was our sporting goods and e-bikes and bikes categories,” Ms. Paul said, noting how the trend was non-existent pre-pandemic. “Obviously, now everyone likes to bike and be healthy.”

With a non-paying loans rate of about 6-7%, Ms. Paul credits the company’s ability to be sustainable to its ability to predict and manage a person’s paying behavior.

Individuals tend to be more responsible when paying for loans on items they aspire to acquire, she said.

“You would be surprised that people are still aiming to buy their first refrigerator or washing machine. People value their first loan if it’s tied to something they’ve aspired to or dreamed of,” she added.