Gross borrowings fall 28% as of end-April

GROSS BORROWINGS dropped by 28% as of end-April, as the National Government saw lower financing requirements despite the prolonged pandemic.

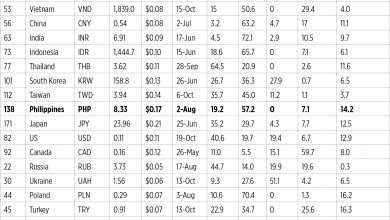

Based on preliminary data from the Bureau of the Treasury (BTr), total gross borrowings stood at P1.18 trillion, lower than the P1.65 trillion seen in the same period last year.

For April alone, gross borrowings plunged by 62% to P101.26 billion year on year.

The government borrows from domestic and foreign sources in order to fund a budget deficit that has since grown due to the need to finance the country’s pandemic response.

Domestic gross borrowings slumped by 37% to P66.38 billion in April, from P106.15 billion a year ago.

The month saw the net issuance of Treasury bills (T-bills) amounting to P34 billion, where more repayments were made than debt incurred.

However, this was offset by fixed-rate Treasury bonds (T-bonds), which raised P100.38 billion.

Foreign gross borrowings plummeted by 78% to P34.88 billion in April. The government raised P28.55 billion from Samurai bonds and P6.33 billion from project loans during the month.

The Samurai bonds, issued on April 12, were the country’s first sustainability bond in the Japanese market. Funds will be used for sustainable development and climate change mitigation initiatives.

The government repaid P5.6 billion to foreign creditors in April.

In the first four months of 2022, gross domestic borrowings fell by 34% to P915.49 billion.

The government generated P457.99 billion from Retail Treasury bonds (RTBs), and P331.24 billion from fixed-rate T-bonds.

Gross external borrowings went up by 9% year on year to P267.9 billion in the four-month period.

The government wants to raise P2.2 trillion to help fund its budget deficit this year, with 75% coming from the local market while the remainder will be loaned from foreign lenders.

As of end-April, the National Government’s outstanding debt stood at a record-high P12.76 trillion. Debt inched up by 0.7% from March’s P12.68 trillion “due to the net issuance of government securities to both local and external lenders and the depreciation of the local currency against the US dollar.”

In an economic bulletin on Saturday, the Department of Finance (DoF) said the recent buildup of debt is mainly due to the country’s pandemic response.

“The pandemic has found the economy more or less in a position of strength and the outgoing administration will be bequeathing the incoming administration with reforms in place with which to reboot and sustain economic growth and execute an orderly fiscal consolidation,” the DoF said.

Tax and structural reforms as well as the infrastructure program “are important ingredients in the country’s economic recovery cocktail that should restore investment-led growth with which to outrun the buildup of debt,” the DoF said.

In addition, the DoF said the incoming government should immediately reform the pension system of the military and uniformed personnel.

“The current scheme is costing the country around P114 billion annually. This is clearly a drag on fiscal policy which will have serious fiscal sustainability implications,” it said. — T.J.Tomas