Philippine inflation eases for 2nd month, backs case for rate hike pause

MANILA – Philippine annual inflation eased for a second consecutive month in March on slower rises in food and transport costs, data showed on Wednesday, supporting the case for the central bank to consider a pause in its monetary tightening cycle.

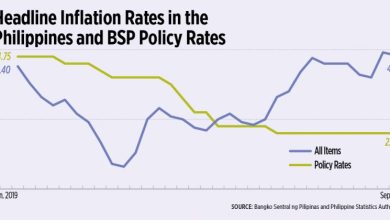

The consumer price index rose 7.6% in March, the statistics agency said, below an 8.0% forecast in a Reuters poll and marking the slowest pace of price increases in six months.

However, confusing the picture core inflation accelerated to 8.0% in March from February’s 7.8%, the fastest pace since 1999.

“While inflation is beginning to slow down, it remains the most pressing issue that the government must monitor and urgently address,” Economic Planning Secretary Arsenio Baliscan said in a statement.

To tackle inflation, the Bangko Sentral ng Pilipinas (BSP) has raised its benchmark interest rate by a total 425 basis points since May last year to 6.25%, and its governor, Felipe Medalla has said future policy moves would be data-dependent.

“The BSP will continue to adjust its monetary policy stance as necessary to prevent the further broadening of price pressures,” the BSP said in a statement, calling for “timely and effective” implementation of non-monetary measures to keep prices in check.

Nicholas Mapa, an economist at ING bank, said a sustained downtrend in inflation could make the BSP consider hitting the pause button on its most aggressive interest rate hiking cycle for years.

“Today’s inflation reading could be one additional data point that could convince Governor Medalla that inflation is finally moderating,” Mr. Mapa told Reuters.

“We expect inflation to moderate further in April which could open up the door for a BSP pause at the May meeting.”

Finance Secretary Benjamin Diokno, who is one of the seven members of the central bank’s policy making monetary board, said on Tuesday, the central bank has probably done enough to address inflation. — Reuters