Yields on gov’t debt rise

YIELDS on government securities (GS) increased last week after US and Philippine central banks doubled down on their hawkish stance.

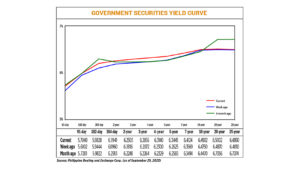

GS yields at the secondary market went up by an average of 5.78 basis points (bps) week on week, according to PHP Bloomberg Valuation Service Reference Rates as of Sept. 29 published on the Philippine Dealing System’s website.

Yields climbed across the board week on week. Rates of the 91-, 182-, and 364-day Treasury bills (T-bills) rose by 9.47 bps (to 5.7049%), 3.84 bps (5.9828%), and 9.81 bps (6.1941%), respectively.

At the belly, rates of the two-, three-, four-, five-, and seven-year Treasury bonds increased by 6.87 bps (to 6.2503%), 7.83 bps (6.2855%), 8.40 bps (6.3140%), 8.20 bps (6.3445%), and 5.55 bps (6.4124%), respectively.

Yields at the long end went up as the 10-, 20-, and 25-year debt papers increased by 1.52 bps (to 6.4902%), 1.32 bps (6.5002%), and 0.80 bp (to 6.489%), respectively.

Total GS volume traded on Friday fell to P10.96 billion from P20.27 billion on Sept. 22.

“Yields were relatively higher [last week] on the short to belly maturities given the higher US yields that saw 10 years break 6.5% support and the possible off-cycle hike statements and pushback of cuts further into 2024 from the BSP (Bangko Sentral ng Pilipinas) governor,” Security Bank Corp. Chief Investment Officer for Trust and Asset Management Group Noel S. Reyes said in an e-mail.

Yield movements last week came after the majority of US central bank officials hinted at prolonged periods of high interest rates, echoing the guidance from the latest US Federal Reserve meeting, a bond trader said in a separate e-mail interview.

The Fed last month kept its key rate between 5.25% and 5.5% and penciled in one more hike before the year ends.

Federal Reserve Bank of New York President John Williams on Friday said the central bank may be finished with rate hikes as inflation pressures are moving toward the 2% target, Reuters reported.

However, Mr. Williams noted that uncertainty about the future remains high and their decisions will always be guided by the data.

Meanwhile, the BSP last month kept its policy rate at a near 16-year high of 6.25%.BSP Governor Eli M. Remolona, Jr. signaled he is open to an off-cycle hike before its next Monetary Board (MB) meeting on Nov. 16 and also ruled out rate cuts in the near term.

“The announcement of a possible rate hike by November at the latest has sustained the overall weaker sentiment and defensive posture of players,” Mr. Reyes said.

For this week, investors may remain defensive as they anticipate the release of September Philippine inflation data on Oct. 5, Thursday, he said.

“Any number lower than last month’s shall trigger buying and anything higher will lead to further selling from the larger probability of an off-cycle hike from the MB. Some support will come out for the longer maturities leading to increased flatness of the curve,” he added.

A BusinessWorld poll of 17 analysts yielded a median estimate of 5.4% for September headline inflation, near the lower end of the BSP’s 5.3% to 6.1% forecast for the month.

If realized, this would be faster than the 5.3% print in August but lower than the 6.9% seen last year. — ACA with Reuters